How to Get Medical Treatment Without Insurance

Share

When you're facing a health problem without insurance, your first move is critical. It's easy to feel overwhelmed, but taking a moment to choose your next step can save you from a mountain of medical debt and help you focus on what matters: your health.

The big question you need to answer is this: Is this a true, life-threatening emergency, or is it something that can be handled outside of a hospital? That single decision is the most important one you'll make for both your physical and financial well-being.

Your First Steps: A Practical Guide to Getting Care

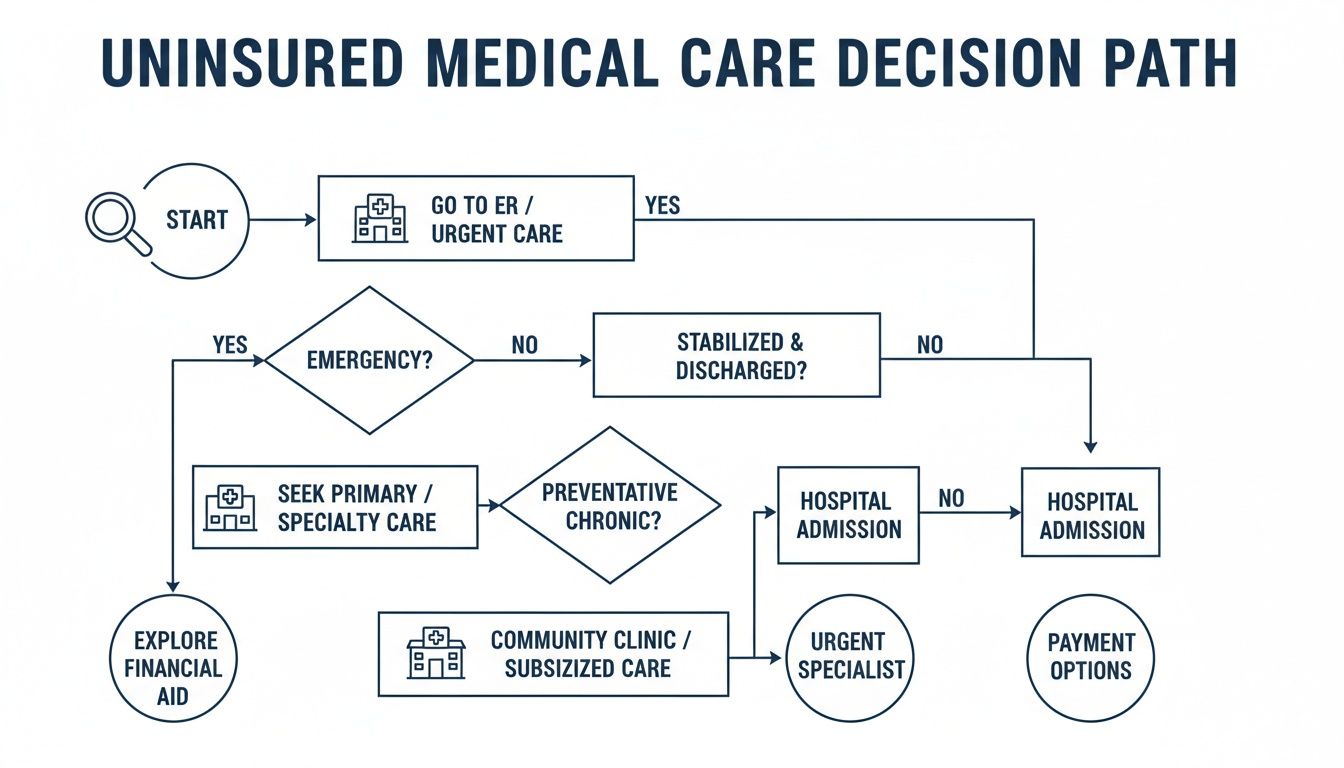

Let's break down the practical steps to getting medical care without insurance. When you're sick or hurt and don't have coverage, the path you take matters—a lot. Your goal is to get the right treatment without ending up with an impossibly high bill, allowing you to stay focused on your long-term wellness goals.

This usually starts with a quick self-assessment.

As you can see, knowing where to go from the start is the key. It sets you on a path toward care you can actually afford, helping you preserve your resources for proactive health investments.

Is It an Emergency or Not?

First things first: take a deep breath and assess your symptoms. This isn't about diagnosing yourself, but about figuring out the urgency of the situation.

Symptoms like severe chest pain, uncontrollable bleeding, sudden trouble breathing, or signs of a stroke are legitimate emergencies. For these, head straight to the hospital ER. Don't hesitate.

But for everything else? A nasty cold that won't quit, a twisted ankle, or a routine prescription refill—an urgent care center or a community clinic is a much smarter, and vastly cheaper, option. The ER is the most expensive place to get medical care, and you want to avoid it unless it's absolutely necessary.

Staying on top of your health, even when paying out-of-pocket, is one of the best ways to avoid huge bills later. Think of check-ups and managing your wellness as an investment in your long-term vitality and healthy living.

Community health clinics are a critical resource. Even in 2023, with 9.5% of non-elderly adults in the U.S. uninsured, Federally Qualified Health Centers (FQHCs) were providing care to millions. These clinics almost always use a sliding-scale fee based on what you can afford to pay.

To help you decide, here's a quick reference for common situations.

Choosing Where to Go: Emergency vs. Non-Emergency Care

| Symptom or Condition | Best Place to Go (Uninsured) | Why It Makes Financial Sense |

|---|---|---|

| Severe chest pain, stroke symptoms | Emergency Room (ER) | This is a life-threatening emergency. Cost is secondary to immediate, advanced care. |

| Fever, flu, or minor cuts | Urgent Care Center | Significantly cheaper than an ER visit for the same level of care. You'll pay a fraction of the cost. |

| Sprains and strains | Urgent Care Center | They have X-ray capabilities but without the massive facility fees of a hospital ER. |

| Prescription refills, check-ups | Community Clinic or Telehealth | These are the lowest-cost options for routine care, often with sliding-scale fees. |

| Skin rash or infection | Telehealth or Urgent Care | A virtual visit can be incredibly cost-effective, but urgent care is great if you need to be seen in person. |

Ultimately, choosing the right facility is about matching the severity of your condition with the most cost-effective option available.

Being prepared financially is also a huge part of the equation. One of the smartest things you can do is learn how to build an emergency fund to handle unexpected costs.

Finding Affordable Local Clinics and Hospitals

So, you know you need care, but it’s not a life-threatening emergency. The big question is: where do you actually go? The good news is that most communities have a safety net of clinics and hospitals designed to help people without insurance or with limited incomes. Finding these local resources is your first real step toward getting affordable treatment.

These places are the backbone of accessible healthcare. They handle everything from routine check-ups to managing chronic conditions, which is absolutely essential for your long-term health and longevity. They all operate on the simple principle that quality care shouldn't depend on your bank account.

Your Map to Local Healthcare Resources

The best place to start looking is with Federally Qualified Health Centers (FQHCs). These are community-based clinics that get federal funding specifically to provide primary care in underserved areas. A huge plus is that they are required to offer a sliding-scale fee discount program, making their services genuinely affordable.

Beyond FQHCs, keep an eye out for:

- Free and Charitable Clinics: These are often staffed by volunteer doctors and nurses, offering care at no cost or for a small donation.

- Public Hospitals: County or city hospitals frequently have charity care programs to reduce or even eliminate bills for low-income, uninsured patients.

- Urgent Care Centers: While they aren't as cheap as a community clinic, many have clear self-pay pricing that’s much more manageable than an ER bill for the same issue.

A single phone call can save you a world of stress. Before you even book an appointment, just ask: "Do you have a self-pay discount or a sliding-scale fee program for uninsured patients?" Asking this one question upfront can prevent a massive financial headache down the road.

How to Find Clinics Near You

Finding these places is easier than you might think. A fantastic tool is the official HRSA Find a Health Center search, which lets you look for FQHCs right in your neighborhood.

Another invaluable resource is simply dialing 211 on your phone. It's a helpline that connects you with local social services, and they can point you toward nearby low-cost medical clinics.

The challenge of navigating healthcare without insurance is something many countries have already tackled head-on. As of 2025, a surprising 78 countries worldwide have some form of free or universal healthcare. Nations like the UK, Canada, and many across Europe provide essential services at no direct cost, a model that really highlights the global consensus on accessible care. You can discover more about which countries offer universal healthcare to see how different systems work.

Understanding Sliding-Scale Fees

What exactly is a "sliding-scale fee"? It’s a pretty straightforward, income-based model. The clinic sets a standard price for a service, but what you pay is adjusted based on your household income and family size, usually compared to the Federal Poverty Level.

To qualify, you’ll just need to bring some basic paperwork.

- Recent pay stubs or your last tax return

- Something that proves your address (like a utility bill)

- A form of identification

Having these documents ready before your first visit will make the whole process much smoother. It ensures you get the care you need at a price you can actually afford, letting you focus on what really matters—your health. For anyone looking into specific treatments like our GLP-1 program, having an affordable primary care doctor for regular check-ins is a crucial part of a complete wellness plan.

Ready to see what modern, direct-to-you options might fit your goals? Take our quick health assessment and start your journey with Blue Haven Rx today.

How to Actually Afford Your Prescriptions

Getting a diagnosis is one thing; figuring out how to pay for the medication without insurance is a whole other battle. But here's the thing: that first price you hear at the pharmacy counter is almost never the final price. You have options.

It all starts with a simple conversation. Don't be shy about telling your doctor that cost is a major concern. They are your biggest advocate and can help you find a treatment plan that actually works for your wallet and your long-term health.

Your First Stop: The Doctor’s Office

Before you even get the prescription slip in your hand, you can start steering things in a more affordable direction. Your doctor wants you to get better, and most are very aware of how crushing medication costs can be.

A few questions can make a world of difference:

- Go Generic: Always ask if there’s a generic version. They have the same active ingredients as the brand-name options but often cost a staggering 80-85% less.

- Ask for Samples: Especially for a new medication, see if the office has any free starter samples. This can easily cover you for a week or two while you sort out the best way to pay for it long-term.

- Consider Older Drugs: Sometimes the newest drug is only slightly more effective than an older, trusted alternative that costs a fraction of the price. It never hurts to ask if an established medication is an option for you.

A prescription isn't set in stone. Think of it as a recommendation. You have every right to talk through the options with your provider to find a solution that fits your health needs and your budget.

Use Modern Tools to Find the Best Price

These days, you have powerful price-slashing tools right on your phone. Prescription discount services like GoodRx or SingleCare are completely free and can save you a ton. They work by negotiating lower prices directly with pharmacies—all you have to do is pull up the coupon on your phone and show it to the pharmacist.

Another game-changer is direct-pay telehealth. This approach is really shifting how people get ongoing care, especially for managing things like weight and healthy aging. For people paying out of pocket, learning about different models like accessing private prescriptions in the UK can open your eyes to what’s possible.

Modern telehealth platforms cut out the middleman, connecting you straight to a provider with clear, upfront costs. No surprises. This is exactly the model we use at Blue Haven Rx for treatments like our GLP-1 program, making it possible to manage your weight without the insurance runaround. To see how simple it can be, check out our guide on how to get a prescription online.

By pairing these strategies—speaking up for yourself in the doctor's office and using the best digital tools available—you can take back control over your medication costs. Being proactive is the key to staying healthy and living the vibrant life you want.

If you’re ready to explore wellness treatments with transparent, honest pricing, learn more about how Blue Haven Rx can help.

Negotiating and Managing Your Medical Bills

Getting a massive medical bill can be a heart-stopping moment. But take a deep breath. That first number you see is almost never set in stone; think of it as the opening offer in a negotiation, not the final word.

The first move is yours, and it’s a simple one: call the hospital or clinic’s billing department and request a detailed, itemized statement. The summary page they send initially isn't good enough. You need the full breakdown of every single charge, right down to the last aspirin.

Put Your Bill Under the Microscope

With the itemized bill in hand, it’s time to play detective. The reality is that medical billing systems are incredibly complex, and mistakes happen all the time. Your job is to spot anything that looks even slightly off.

Keep an eye out for these common slip-ups:

- Duplicate Charges: It's surprisingly easy to get billed twice for the exact same service or medication.

- Canceled Services: Were you charged for that lab test your doctor ordered but later decided you didn't need? Make sure you didn't pay for something that never happened.

- Wrong Quantities: Did they bill you for a full box of sterile gloves when the nurse only used one pair? Check the numbers.

- Upcoding: This is a sneaky one. It’s when a provider bills for a more complex and expensive version of the service you actually received.

If you spot something that doesn't add up, circle it. A quick, polite phone call to the billing department to ask for clarification can often get these charges removed without much of a fight.

How to Start the Negotiation

Once you've cleared up any obvious errors, the real negotiation begins. Remember that you're not the first person to call them about a high bill—they have entire departments dedicated to this. Being polite, firm, and prepared is your best strategy.

When you get them on the phone, your first question should be about the "self-pay" or "cash-pay" discount. Hospitals negotiate much lower rates with insurance companies, and they will often extend that same price to an uninsured patient who knows to ask for it.

You have to be your own advocate here. It can feel intimidating, but don't hesitate to calmly explain your financial situation and state what you can realistically afford to pay.

Studies have found that uninsured patients are sometimes charged 2.5 times more than insured patients for the very same procedure, so this one question can slash your bill significantly.

If the new total is still too much to pay at once, ask for an interest-free payment plan. Most providers would much rather get paid slowly over time than risk getting nothing at all by sending you to collections. Propose a monthly payment that actually works for your budget. This shows you're acting in good faith.

Knowing the potential costs of specific treatments beforehand can also empower you. For example, our guide on how much Wegovy costs without insurance can help you prepare for those conversations. By taking these steps, you shift from being a passive victim of a bill to an active participant in managing your own healthcare costs.

Using Telehealth for Direct and Affordable Care

Healthcare has changed dramatically, and one of the best developments for patients—especially those without insurance—is the rise of telehealth. If your focus is on proactive wellness and healthy aging, these direct-pay services can be a game-changer, letting you skip the insurance runaround altogether.

Digital platforms don't have the same high overhead costs as a traditional doctor's office. That means you can often consult with a specialist from your own home for a simple, flat fee. You see the price upfront, which is a welcome dose of transparency in an industry famous for its confusing bills.

This direct path is incredibly helpful when you're working on long-term goals like weight management or healthy aging, where having consistent, professional guidance makes all the difference.

How Direct-to-Patient Care Works

The direct-to-patient model is refreshingly simple. Instead of juggling appointments, referrals, and co-pays, you connect directly with a medical provider through a secure online platform.

It usually unfolds like this:

- You’ll start with an online health assessment to see if a specific treatment is a good fit.

- Next, you'll have a one-on-one virtual visit with a licensed medical professional to go over your health history and goals.

- If a prescription is appropriate, it’s shipped discreetly right to your door.

This streamlined process is perfect for anyone taking an active role in managing their own health, whether that means losing weight or exploring treatments that support cellular vitality.

By removing the insurance company as the middleman, telehealth puts you back in control. The decisions are made between you and your provider, paving the way for a much more personal and responsive approach to your long-term health.

A Modern Path to Longevity and Wellness

At Blue Haven Rx, we use this direct model to connect you with healthcare professionals specializing in treatments that support your healthy aging goals. For instance, our NAD+ therapy program was designed to be straightforward and accessible, giving you a modern way to invest in your cellular health without needing insurance.

This is about more than just convenience; it’s about making proactive health management a real and affordable part of your life. For anyone paying out-of-pocket, telehealth can be an incredibly cost-effective way to get specialized care. A virtual primary care visit, for example, often lands somewhere between $70 and $300—a predictable cost you can actually budget for.

To get a better sense of how it all works, our detailed article on how telehealth works is a great resource.

Ultimately, telehealth offers a transparent, empowering way to take the reins of your health journey. It puts you firmly in the driver's seat, allowing you to pursue your wellness goals on your own terms.

To find out which options might be right for your unique health profile, you can start by taking our free health quiz and begin your journey today.

Answering Your Questions About Uninsured Medical Care

Going to the doctor without insurance brings up a lot of questions. It's a confusing landscape, but don't worry—you're not the first person to walk this path. Let's tackle some of the most common concerns head-on so you can get the care you need with a little more confidence.

Can an Emergency Room Actually Turn Me Away?

This is a big one, and thankfully, the answer is a clear no.

There's a federal law on the books called the Emergency Medical Treatment and Labor Act (EMTALA). It mandates that any hospital accepting Medicare—which is nearly all of them—has to give you a medical screening if you show up needing emergency care. If they find you have a true emergency, they have to get you stable. Your insurance status or ability to pay can't be part of that equation.

But here’s the critical part: this care isn’t free. Not by a long shot. You will get a bill for every single service, and emergency rooms are hands-down the most expensive place to receive medical treatment. That’s why you have to save the ER for genuine, life-threatening emergencies. For everything else, an urgent care or a community clinic will be much, much easier on your wallet.

Are There Government Programs That Can Help Me Right Now?

Yes, and some can even help you after you’ve already been to the doctor.

The most important one to know about is Medicaid. A lot of people don't realize that in many states, Medicaid coverage can be retroactive. This means it might pay for medical bills from up to three months before you even applied, as long as you were eligible during that time. If you've recently lost your job or are staring down a massive hospital bill, you owe it to yourself to check your state's Medicaid website. See if you qualify and get an application in.

Don't just assume you won't qualify for help. Eligibility rules are always changing, and your own life circumstances can shift you into a category that makes you newly eligible. It costs nothing to check, and it could literally save you thousands of dollars.

How Do I Get on a Clinic's Sliding-Scale Fee Plan?

Sliding-scale fees at community health centers are a game-changer for managing healthcare costs. Getting approved is usually a pretty straightforward process.

Your best bet is to call the clinic before you go in. Just ask them about their financial assistance policy or their sliding-scale fees. They'll tell you exactly what you need, but it almost always comes down to proving two things:

- Your Household Income: A couple of recent pay stubs, a W-2 form, or last year's tax return usually does the trick.

- Your Household Size: This helps them place your income against the Federal Poverty Guidelines to figure out what you'll pay.

Having these documents ready makes the whole process quick and painless. A little bit of prep work means the clinic can adjust your bill to something you can actually afford. This makes it possible to stay on top of your health, which is crucial for long-term wellness and healthy aging.

At Blue Haven Rx, we believe you deserve a clear, direct path to the care you need to meet your wellness goals. If you’re ready to move forward with a team that puts transparency first and empowers patients, we're here for you. Learn more and start your journey with us today.