How to Get Medical Care Without Insurance: A Practical Guide

Share

Needing to see a doctor without insurance can be a stressful experience, but you have more options than you might think. The key is knowing where to look and how to advocate for yourself to find affordable, high-quality care. A little planning can protect both your health and your finances.

This guide provides practical, real-world steps for navigating the healthcare system without insurance. We'll explore everything from community health centers to modern telehealth solutions, helping you make informed decisions for your long-term well-being.

Your First Steps When You Need Care Without Insurance

Trying to figure out healthcare without a safety net is daunting, especially when you’re already feeling unwell. Taking a moment to create a game plan can save you stress and thousands of dollars. This isn't just about solving a problem today; it's about finding a sustainable way to manage your health for the long run.

If you find yourself in this situation, you are far from alone. In 2023, 25.3 million people in the United States were uninsured. Many people delay getting help because they worry about the cost, but this can turn a small, manageable issue into a much larger and more expensive one. Prioritizing your health now is a key part of healthy aging and longevity.

Assess Your Immediate Needs

First, determine how urgent your medical need is. Is it a life-threatening emergency, or can it wait for a scheduled appointment? Your answer will guide you to the right type of care.

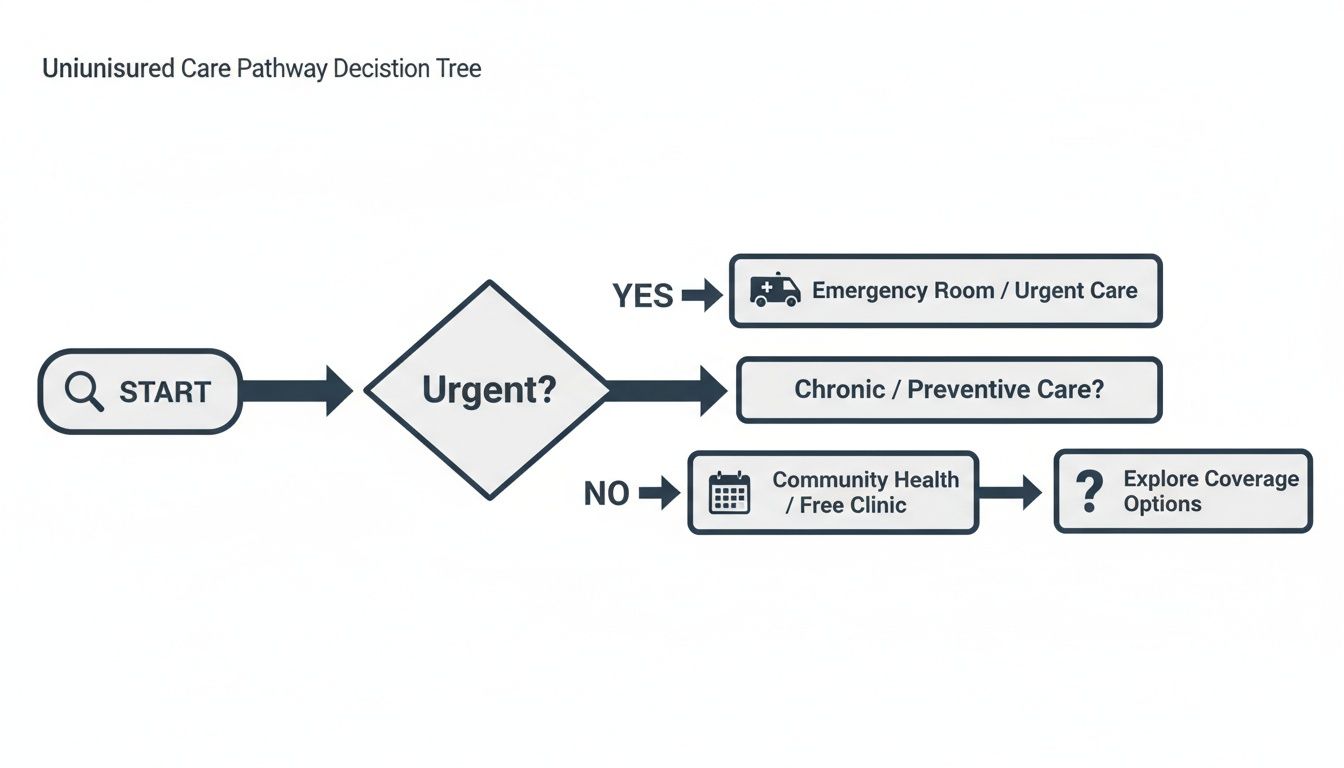

This flowchart gives you a quick visual of the best path to take.

As you can see, the most affordable and appropriate options depend on whether you're dealing with an emergency or a more routine health concern.

When you're uninsured, choosing where to go is half the battle. This table breaks down your best immediate choices.

Immediate Options for Uninsured Medical Care

| Care Option | Best For | How to Find It |

|---|---|---|

| Urgent Care Center | Non-life-threatening issues like sprains, colds, or minor infections. | Search online for "urgent care near me" and call ahead to ask for their self-pay rate. |

| Community Health Center | Primary care, check-ups, and managing chronic conditions. | Use the HRSA Find a Health Center tool to locate federally qualified centers. |

| Hospital Emergency Room | True emergencies only—severe injuries, chest pain, difficulty breathing. | Go to the nearest hospital ER. Ask about financial assistance or charity care after your visit. |

These are your front-line options, each serving a different purpose. Choosing the right one is the first step in keeping your costs manageable.

Preparing for Your Visit

Once you know where you're going, a little preparation goes a long way. You are your own best advocate. Gather any medical records you have, and write down a list of your symptoms and any questions you have for the doctor.

If you need help with a specific issue, like getting an ADHD evaluation, it helps to research the process. For instance, knowing how to get an ADHD diagnosis without insurance can clarify the steps involved.

The same applies to prescriptions. Understanding how telehealth can simplify this process is empowering. You can learn more in our guide on how to get prescription online. Taking control of your health journey starts with having the right information.

Finding Affordable Care in Your Community

When you’re uninsured and need medical help, your local community is often the best place to start. While an expensive urgent care clinic or the ER might seem like your only options, community-based services can connect you with high-quality, affordable care designed for people in your exact situation.

Think of these local clinics as the healthcare system's safety net. They exist to ensure that a lack of insurance doesn't become a barrier to essential care—a critical service for managing your health and preventing small problems from becoming big ones. This proactive approach is fundamental to long-term wellness and healthy living.

What Are Community Health Centers?

At the heart of this local system are Federally Qualified Health Centers (FQHCs). These are community health hubs that receive federal funding to provide primary care in underserved areas. Their mission is to serve everyone, regardless of their ability to pay.

This is where the sliding-scale fee system comes in. The amount you pay is tied directly to your income and household size. For someone with a low income, a full doctor's visit might only cost $15 or $20—a fraction of what you’d pay out-of-pocket at a private practice.

Practical Tip: When you call to make an appointment, mention that you are uninsured and ask about their sliding-scale program. They will tell you what documents (like a pay stub) to bring to your first visit.

These centers offer much more than just a quick check-up. Many FQHCs provide a whole range of services under one roof, including:

- Primary medical care for adults and children

- Dental services

- Mental and behavioral health counseling

- Lab work and basic diagnostic tests

- On-site pharmacies with reduced-cost medications

This all-in-one approach is incredibly helpful. You can manage different aspects of your health in one familiar place, which is a game-changer when you're trying to maintain a healthy lifestyle or manage weight without incurring multiple specialist bills.

How to Find a Clinic Near You

The good news is that finding these centers is easier than you might think. Official directories are designed to connect you with FQHCs and other free or charitable clinics in your area. You don't need a referral; you can simply look them up and call directly.

Your best bet is to start with the official government locator managed by the Health Resources and Services Administration (HRSA). Just enter your address, and it will pull up a map of all the FQHCs nearby.

Let's walk through a real-world scenario. Say you have high blood pressure but just lost your insurance. You need a check-up and a prescription refill. Instead of paying over $150 at a private doctor's office, here’s what you’d do:

- Go to the HRSA Find a Health Center tool online.

- Find a clinic a few miles from your home.

- Call to schedule a new patient appointment and mention you're uninsured.

- They'll likely ask you to bring proof of income to your first visit to get you set up on their sliding-scale program.

At your appointment, you’ll receive the same professional, high-quality care you'd expect anywhere else. These clinics focus on preventative care to keep the community healthy, which perfectly aligns with goals like weight management and long-term wellness.

Looking into affordable care options for self-pay patients can give you even more ideas. And if you have a specific goal in mind, you can find guides on topics like achieving weight loss without insurance to see how different strategies can work together for you.

What to Do About Hospital Bills and Financial Aid

An unexpected hospital visit is stressful enough without the large bill that often follows. However, many people don't realize that most hospitals in the U.S. are non-profits and are often required to offer financial assistance to those who cannot afford to pay. This is frequently called charity care, and it can significantly reduce your bill or even eliminate it entirely.

Knowing how to access these programs is about being your own best advocate. It’s about asking the right questions before medical debt has a chance to take hold.

How to Find and Apply for Hospital Financial Assistance

The single most important thing you can do is be proactive. Don't wait for a bill to arrive in your mailbox weeks after a procedure or an emergency room visit. Start the conversation about financial help while you're still at the hospital.

Every non-profit hospital must have a formal Financial Assistance Policy (FAP). You have a right to see this policy and get a simple, plain-language summary of it. This document is your roadmap—it explains exactly who qualifies and how to apply.

Here’s how to get started:

- Ask for a Patient Advocate or Financial Counselor. These individuals are there to help you. When you’re at the registration desk, simply say, "Could I please speak with a financial counselor?"

- Check the Hospital's Website. Most hospitals provide this information online. Search for terms like "Billing," "Patient Resources," or "Financial Assistance" to find the policy and application forms.

- Prepare Your Paperwork. You will likely need to provide proof of your income and household size. Gather recent pay stubs, your previous year's tax return, or a letter from your employer.

Simply being uninsured often means you should be screened for these programs. Between 2000 and 2020, U.S. hospitals provided an estimated $110 billion in uncompensated care, a significant portion of which was charity care for qualifying patients. You can learn more about these policies on the KFF website about the uninsured population.

Talking Costs and Negotiating What You Owe

What if you don't qualify for full charity care? You still have options. The initial price on a hospital bill is rarely the final price you have to pay. It’s a starting point for a conversation.

Let’s say you went to the ER for a cut that needed stitches, and the bill is a shocking $1,500. Here’s how you could handle it:

- Request an Itemized Bill. Your first call to the billing department should be to request a detailed, itemized statement. You might be surprised to find errors, duplicate charges, or services you never received.

- Ask for the "Self-Pay" Discount. When you call back, lead with this: "I'm a self-pay patient, and I need to discuss my options." Then, ask directly if they offer a discount for patients paying out-of-pocket.

- Offer a Lump-Sum Settlement. If you have some savings, you can try to settle the debt for less. You could say, "I can pay $600 today if you'll accept that as payment in full." Hospitals often prefer receiving some money now over pursuing the full amount for months.

- Request a Payment Plan. If a lump sum isn't feasible, ask for an interest-free payment plan. This allows you to pay off the balance over time without extra costs.

Practical Tip: The best way to avoid large medical bills is to invest in your long-term wellness. Prioritizing things like weight management and a healthy lifestyle can dramatically lower your risk of chronic conditions that lead to expensive, ongoing care.

This approach puts you in control of your financial health. To see how our programs could support your wellness journey, start with our quick online quiz.

Using Telehealth and Prescription Savings Programs

Getting medical care doesn't always require a trip to a doctor's office. Technology has created convenient new ways to get professional advice from home, and telehealth is a game-changer for anyone without insurance.

It's an accessible and often much cheaper way to handle medical needs, especially when you're focused on long-term goals like weight management or healthy aging. Instead of paying $150 or more for a standard office visit, a telehealth consultation can be a fraction of that cost. This makes it easier to stay on top of your health and manage prescriptions without facing a large bill each time.

The Power of Virtual Consultations

Telehealth is simple: it connects you with a licensed doctor or healthcare provider through your phone, computer, or tablet. It’s ideal for non-emergency situations like colds, skin issues, follow-up care, mental health support, and managing chronic conditions.

This direct access to a professional is especially useful for specific health goals. For instance, some services use a telehealth model to connect you with providers who can discuss and prescribe treatments like GLP-1 medications for weight management. This approach simplifies the process, making it easier to be proactive about your health, even without insurance.

Embracing virtual care isn't just about saving money on one appointment. It's about creating a sustainable, long-term plan to manage your health and lower the risk of more expensive problems in the future.

If you want to know more about what a virtual visit is like, our guide on how telehealth works breaks down the entire process. It’s a modern way to take control of your well-being on your own schedule.

Making Prescriptions More Affordable

Getting a prescription is one thing; paying for it is another. Fortunately, you have powerful tools to lower those costs. The most important rule is to never accept the first price you see at the pharmacy.

One of the easiest things you can do is use a prescription discount card or app. These services are free and can provide significant savings by negotiating lower prices with pharmacies. All you usually need to do is show a coupon on your phone.

Here are a few other proven strategies:

- Look for Patient Assistance Programs (PAPs): Most major pharmaceutical companies have programs to help uninsured individuals who meet certain income requirements. A quick online search for the drug manufacturer's name plus "patient assistance program" is the best place to start.

- Always Ask for the Generic: Ask both your doctor and your pharmacist if a generic version is available. Generics have the same active ingredients and are just as effective but can cost 80-85% less than brand-name drugs.

- Compare Prices: Don't automatically go to the nearest pharmacy. Prices for the same medication can vary significantly between stores. Use an online tool or app to check prices at different pharmacies near you.

By pairing the convenience of telehealth with smart prescription-buying habits, you can build a solid foundation for your health. This is particularly important when you’re managing your weight or focusing on longevity, where consistent access to care and medication makes all the difference.

Navigating Lab Work and Specialist Visits on a Budget

So, you’ve handled the initial doctor's visit. But what about the next steps? Lab work and specialist appointments are often where costs start to add up, and the fear of a large bill can be intimidating. The good news is, you have more control here than you might realize. Let's discuss some practical strategies to get the diagnostic tests and expert care you need without draining your savings.

These are sustainable ways to manage your health long-term, whether you're monitoring a chronic condition or working toward goals like healthy aging or weight management.

Find Affordable Lab Testing

Here's a game-changer many people don't know about: direct-to-consumer lab testing. These services let you order your own blood work online, bypassing the need for a doctor's referral and the inflated prices that often come with it.

The process is straightforward: you order the specific tests you need from their website, they direct you to a local partner lab for a quick blood draw, and you receive your results securely online. This is perfect for routine monitoring. If you need to check your cholesterol, A1c, or thyroid levels, you can often get these panels for under $50—a huge saving compared to the hundreds you might be billed through a hospital.

See a Specialist Without Breaking the Bank

The thought of paying for a specialist out-of-pocket can feel overwhelming. But just like with urgent care, being a self-pay patient gives you leverage. Most specialists have a discounted "cash price" that is significantly less than what they bill insurance companies. You just have to ask for it.

Practical Tip: When you call to book an appointment, use this simple script: "Hello, I'd like to schedule an appointment. I'm a self-pay patient without insurance. Could you please tell me what the cash-pay price is for a new patient consultation?"

This immediately frames you as an informed consumer and opens the door to a more manageable fee.

Another excellent, often-overlooked option is to look into medical schools or university-affiliated hospitals. Their clinics are staffed by residents (doctors in training) who are supervised by top-tier specialists. You receive high-quality care, but the cost is typically a fraction of what you'd pay at a private practice.

Navigating healthcare costs is a global challenge. While health service coverage has improved in 97% of countries since 2000, access remains unequal. In some areas, lower-income populations face a 32% higher rate of unmet medical needs. You can explore these global trends in the World Bank's 2025 report.

Cost Comparison for Common Medical Services

This table shows just how much you can potentially save by seeking out self-pay or direct-pay prices instead of going through the traditional billing system.

| Service | Typical Billed Rate | Potential Self-Pay or Direct Cost |

|---|---|---|

| Basic Metabolic Panel (BMP) | $150 - $300 | $30 - $50 |

| Lipid Panel (Cholesterol) | $100 - $250 | $25 - $45 |

| Thyroid Panel (TSH, T3, T4) | $200 - $450 | $45 - $75 |

| New Patient Specialist Visit | $300 - $600 | $150 - $250 |

The savings are substantial. Being proactive and asking for cash prices empowers you to get the care you need at a price you can afford.

These strategies are vital for staying on top of your health. Regular monitoring is fundamental to longevity and complements other proactive therapies like NAD+ for cellular health. Affordability is also a major factor for those considering weight loss medications. If that's on your radar, learn more by reading our guide on how much Wegovy costs without insurance.

By putting these practical tips to use, you can confidently manage your health, even without an insurance card in your wallet.

Answering Your Top Questions About Getting Healthcare Without Insurance

Navigating medical care when you're uninsured can bring up many questions and a lot of anxiety. It’s completely normal to feel overwhelmed. Here are some straightforward answers to the questions we hear most often.

Let's clear up some of the confusion so you can feel more in control of your health journey.

What’s the Very First Thing I Should Do If I Need Care Right Now?

If you're facing a true, life-threatening emergency, go to the nearest emergency room immediately. Federal law requires hospitals to stabilize you, regardless of your insurance status or ability to pay. Your life comes first.

For everything else—urgent but not life-threatening issues like the flu, a sprain, or an infection—your best option is a community health clinic or a Federally Qualified Health Center (FQHC). These centers were created to serve people without insurance and operate on a sliding scale based on what you can afford. A visit might cost as little as $20, while a private urgent care clinic could easily cost $150 or more.

Can a Hospital Actually Help Me with the Bill?

Yes, and you should absolutely ask for help. Most hospitals in the United States are non-profits, which means they are legally required to offer financial assistance programs, often called "charity care." These programs can significantly reduce your bill or even eliminate it completely.

Eligibility is typically based on your income and household size. The most important thing is to act quickly.

Practical Tip: Don't wait for a bill to arrive in the mail. As soon as you can, ask to speak with a "Financial Counselor" or "Patient Advocate." Their job is to help people like you navigate these programs.

If possible, bring a recent pay stub or tax return to speed up the application. You have a right to this assistance, so don't hesitate to ask for it.

Is It Really Possible to Negotiate My Medical Bills?

Absolutely. You should never view the first bill you receive as the final word. Think of it as an opening offer. The world of medical billing is complex, and errors are common.

Your first step is to call the billing department and request a detailed, itemized bill. Review every single line item. Are there duplicate charges? Do you see services you never received?

Once you’ve reviewed it, try these proven tactics:

- Ask for the self-pay or cash-pay discount. Most providers have a lower rate for patients who aren't using insurance.

- Offer to pay a smaller amount in full. If you have cash on hand, you can often settle a large bill for a fraction of the cost by offering a one-time payment.

- Set up a payment plan. If a lump sum isn't an option, ask for an interest-free payment plan that fits your budget.

Clear and persistent communication is your greatest asset. A polite but firm approach can save you hundreds or even thousands of dollars.

How Can I Tackle Something Like Weight Loss Without Insurance?

Focusing on long-term health goals, like managing your weight, is one of the smartest things you can do to avoid expensive medical problems down the road. It’s an investment in your future well-being and longevity.

While a healthy diet and exercise are the foundation, getting clinical support for weight management has become much easier thanks to modern telehealth services.

Direct-to-consumer programs like Blue Haven Rx have opened the door for people without insurance to connect with licensed medical providers. Through this model, you can get consultations and access to treatments like GLP-1 medications without needing a traditional insurance plan. It’s a proactive and affordable way to take charge of your health.

At Blue Haven Rx, we believe your health shouldn't depend on your insurance status. Our telehealth platform was built to make effective, science-backed weight management accessible to everyone.

Ready to invest in your long-term wellness? Start your journey today.